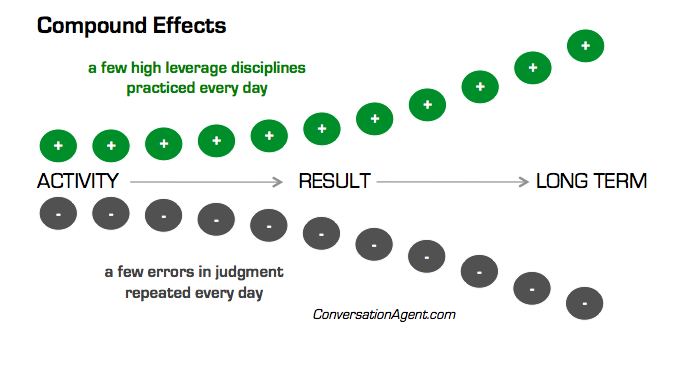

The Compound Effect

Darren Hardy, 2012, The Compound Effect: Jumpstart Your Income, Your Life, Your Success

Book Image

Overview

Basic investment types

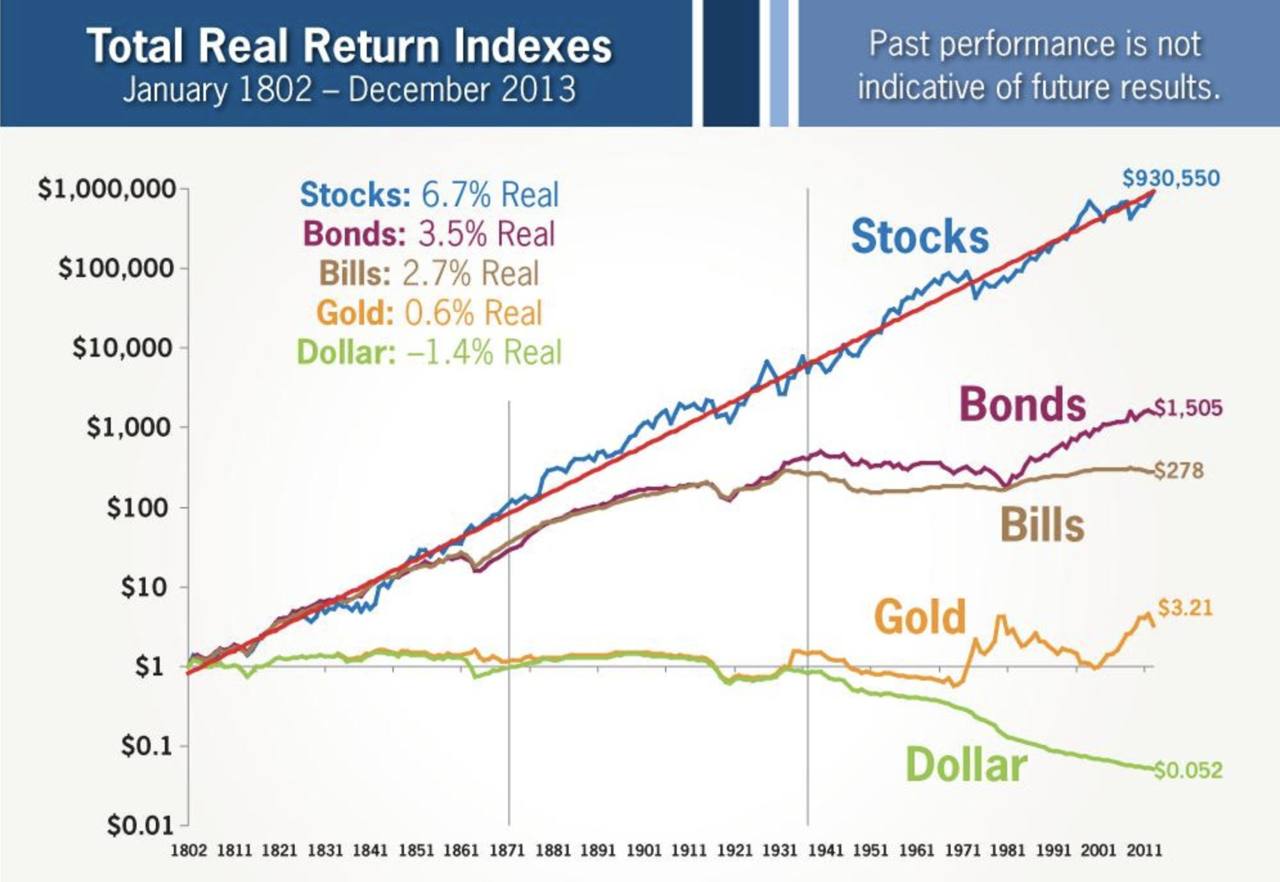

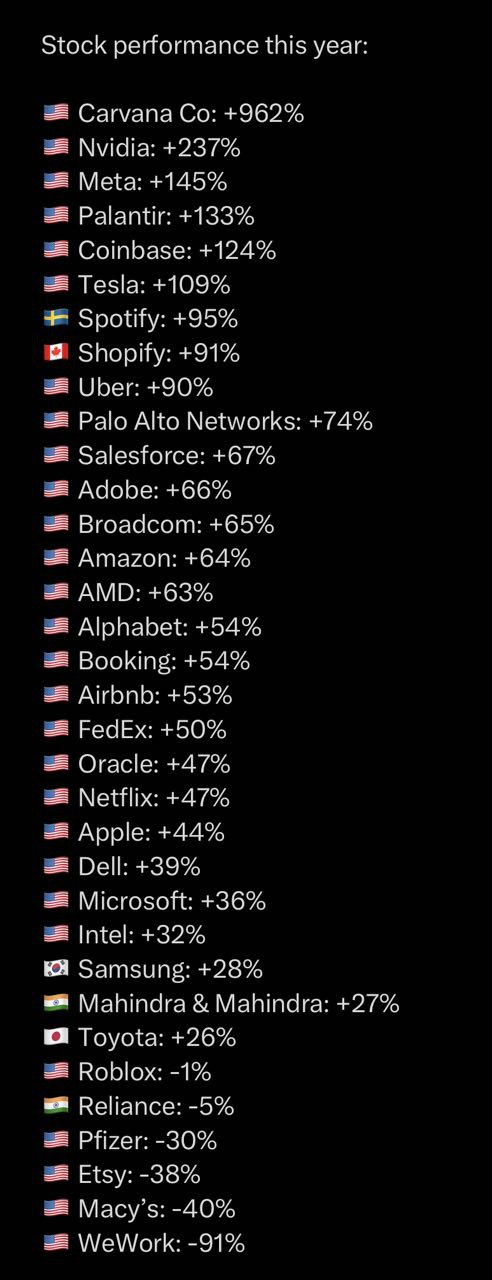

Stocks: Stocks represent ownership in a company and can provide returns through capital appreciation and dividends.

Index Funds: These are investment funds that aim to replicate the performance of a specific market index, such as the S&P 500.

Startups: Investing in startups involves providing capital to early-stage companies in exchange for equity, with the potential for high returns if the company succeeds.

Bonds: Bonds are debt securities issued by governments or corporations, offering periodic interest payments and return of principal upon maturity.

Real Estate: Real estate investments involve buying and owning physical properties, such as residential or commercial real estate, to generate rental income or capital gains.

Cryptocurrency: Cryptocurrencies like Bitcoin and Ethereum are digital assets that use blockchain technology for transactions and have gained popularity as speculative investments.

Futures: Futures contracts allow investors to speculate on the future price of commodities, currencies (Forex, Foreign exchange market), or financial instruments, often used for hedging or trading purposes.

Gold: Gold is a precious metal that investors buy as a store of value or a hedge against inflation and economic instability.